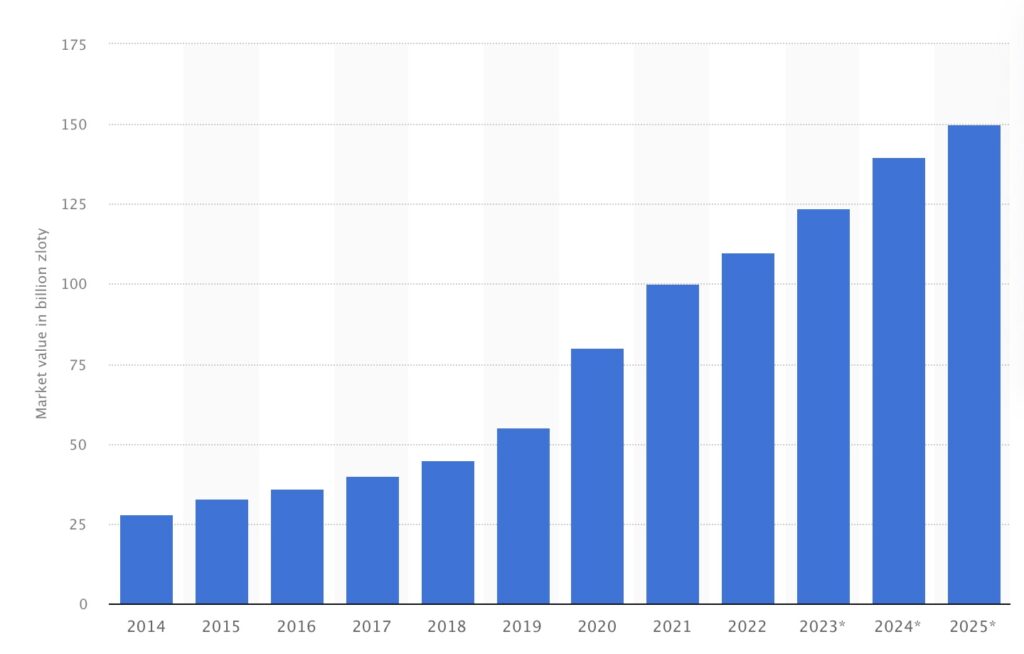

Focusing on the Polish e-commerce market, data from the Polish government’s internet sources reveals a remarkable fivefold growth in the value of the B2C e-commerce sector over the past decade. Currently, more than 150,000 businesses actively engage in online sales, operating through various channels such as online marketplaces and their own e-commerce platforms.

Value for the e-commerce market in Poland 2014-2022 (+forecast), Source: Statista

In addition, Poland stands out as a European leader in mobile banking usage, with over 22 million users in 2022, and an impressive 88% of them actively employing mobile apps for their banking needs.

One notable aspect of the Polish e-commerce landscape is the diverse range of delivery options available to consumers. While options abound, parcel machines emerge as the preferred choice, with a significant 81% of local e-commerce shoppers opting for this method. InPost dominates this market segment, closely followed by DPD, Allegro, and other providers. As reported by www.money.pl, InPost’s ownership of parcel machines in Poland reached 19,306 in 2022, underlining its dominant position in this rapidly evolving market.

As mentioned above, the number of Polish e-commerce market players is significant. However, there are some clearly preferable online channels. What makes Poland truly unique is the fact that Amazon, staying 5 years on the market, hasn’t won the leadership.

The local population votes for the local brand in e-commerce: the most popular online marketplace is Allegro.pl with at least 85% of the market share. Allegro was founded in 1999 and is currently owned by a group of foreign investors. In 2021 Allegro raised $2,3bln in IPO and in 2022 acquired popular marketplaces in the Czech Republic and Slovenia.

Other marketplaces (significantly less popular) are Amazon, Zalando, and AliExpress.

The most popular categories ordered online in Poland are the same as everywhere: footwear and apparel, cosmetics and perfumes, books, electronics, and appliances. The cosmetics category) represents one of the fastest-growing product segments in Polish e-commerce. For example, one of the sub-categories (make-up and nails) is predicted to reach $291 mln. by the end of 2023.

All in all, the Polish e-commerce market is one of the fastest growing in the EU, but also very specific. For example, Allegro’s algorithm is believed to be different from one of Amazon’s, which means companies that want to sell locally (and in the Czech Republic and Slovenia) need to invest in this algorithm learning process or collaborate with local sellers.