In the bustling landscape of food retail in Poland, a testament to the nation’s three decades of economic perseverance, a remarkable transformation has unfolded. From experiencing the highest GDP growth in Europe between 1990 and 2020 to achieving living standards akin to Western Europe, Poland stands as a beacon of resilience.

With an unemployment rate below 5%, the country’s economic prowess is undeniable. As we delve into this article, we’ll navigate through the vibrant world of Polish food retail, exploring its major players, market dynamics, and the ever-evolving tastes and preferences of its consumers.

Being a strong manufacturer and exporter , Poland also remains a promising potential market for different products. The Poles travel a lot in different countries, discover new markets, new products, and new trends, and want to see them in their own market. For example, Chinese, Mexican, Georgian, and Vietnamese food are becoming more and more popular in the country.

Leading food retail chains

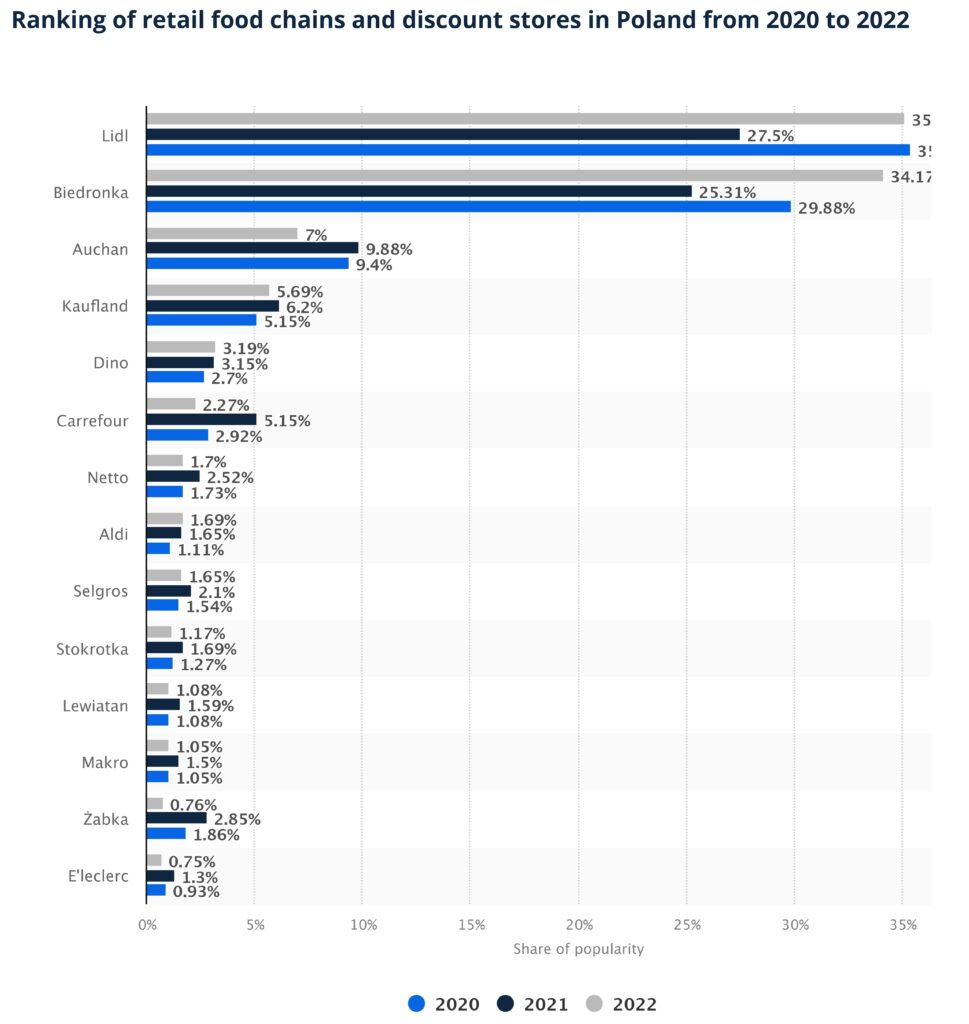

According to Statista, the two biggest retail chains in Poland are discounters chains:

- Biedronka (around 3400 stores, belongs to a Portuguese company Jeronimo Martins)

- Lidl (German retail tycoon operates with 800+ stores in the country)

These companies support all the rules of discounter formats, and private-labe products dominate the shelves. These two players hold almost equal market shares in 2022 (35% each).

Other companies that are famous (although have much less influence) are Auchan, Kaufland, and Dino (around 15% market share altogether). Auchan claimed to achieve 11 bln PLN in revenue in 2022 (2,5 bln Euro)

Other retailers have less than 3% market share.

A famous and popular retailer that is working in a specific niche (small stores, open every day) is Zabka. Zabka offers a franchise agreement to entrepreneurs, and its points of sale are available in every sleeping area, train station etc. across the country. There are at least 9000 stores in that chain. The interesting thing about Zabka is that the company (owned by an American equity fund) permanently experiments with innovative formats. For example, Zabka Nano is the biggest chain of autonomous (personnel-free) stores in Europe.

The companies emphasize that they sell a lot of local products. For example, Biedronka developed a special program targeting to improve direct collaboration with local farmers. Still, some products are not available on the market. For example, the retailers purchase fruits and vegetables from the outside of the country during the winter. In some trendy segments, for example, functional food, both local and foreign companies compete fiercely.

Despite strong economic growth in the last 30 years, Poland remains a price-sensitive market. Low and middle-price segments are dominating. However, premium products might also find their niche if the vendor is ready to justify the higher price and invest in aggressive marketing.

One format that stays aside in Poland and is very special is drugstore. Rossmann is an absolute leader in the format (with 1600+ stores). Rossmann stores are very popular and convenient. Although the main turnover comes from cosmetics and homecare products, the categories like baby food, functional food, dietary supplements, and even alcohol (exclusively wines) are well presented on the Rossmann shelves.

See this article on Austrian Food Retailers: https://manatex.co/austrian-retail-market-opportunities-and-challenges/