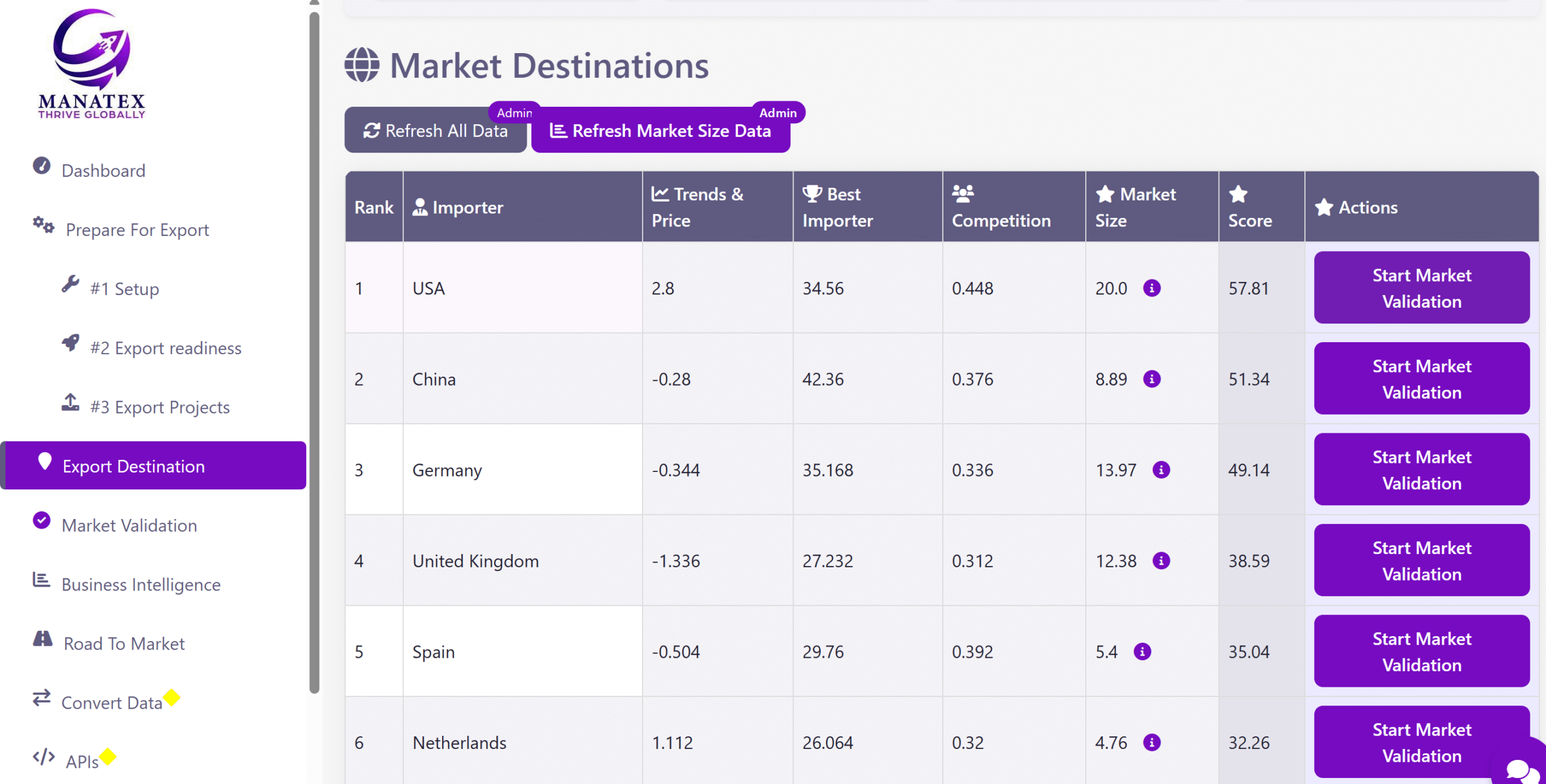

Your pricing structure defines your commercial strategy for a product or service in a target market.

The price structure also includes all trade discounts and offers (commercial conditions). This might sound trivial but in practice, this is a very challenging task to make your pricing model work for the sake of the company.

Let’s look at the simple pricing structure for a consumer product and get through each part:

Picture #1: Simple price structure for the product distributed in retail in countries with VAT

The picture above makes it obvious that the price structure for a product in a new market is like an equation with many unknowns. This is a high competence to manage it, especially in a new market.

How a company can build such a model from scratch when it comes to a new market?

Let’s look at this step by step:

-

Recommended Retail Price (also known as Recommended Shelf Price, RSP, or RRP)

This is the price you’re going to charge your end user. In some countries, shelf price includes Value added tax (VAT) that can be different in different countries. For example, the current VAT in France is 20%. How to charge RSP in a new country? This is usually the most difficult and unknown part. On the one hand, to avoid grey importation (especially valuable products like electronics, luxury etc) pricing policies in different markets should be aligned. On the other hand, to avoid financial loss of the company’s marketing and sales team should do research and understand the TEV (True Economic Value) of the product in a new market.

Picture #2: Value pricing thermometer

The famous model of a Value Pricing Thermometer explains how vendors often leave money on the table when charging consumers RSP on the level below TEV. The key to this aspect of pricing is deep market and competition knowledge and decent marketing efforts.

-

Front and Back margin of the retailer

The front margin corresponds to the gross margin retailer earns on a product. It depends on the market, product category, and retail format. Supermarket format clearly has a higher markup and consequently a higher margin than Discounter. In consumer electronics retail, accessories (headphones for example) contribute to the margin of the category much more than TVs. Again, to find out precise expectations on the market, several interviews with different sources should be done before the negotiations.

It’s clear from the price structure model (Picture #1) that if a vendor knows how to supply the product directly to retail, both parties will avoid an intermediary and earn more on the deal. However, there are several obstacles: a) If this is a new market and a company can’t afford to open a subsidiary, then someone must handle importation and certification (if applicable). In some countries, retailers do that themselves but not in others they don’t. b) Retailers are reluctant to organize any promotion of the product. On the other hand, if a new product doesn’t show a sell-out result, it’s getting quickly delisted.

The back margin includes all possible retro-bonuses, coop budget merchandising, listing fees etc. Listing fees are legally prohibited in many countries (for example, most EU markets) but in some countries, a vendor still must “buy a ticket to a shelf”, the companies then charge for each SKU and each store in the retail chain.

-

Front and Back margin of the distributor

Reliable distributors often must handle a lot of tasks: logistics, importation, certification, local listings, e-commerce platforms operations, sales, and marketing team management. They expect this business to be profitable. Again, their margin depends on many factors (category, market, and functionality). Sometimes margin of the distributors significantly varies even in the neighboring countries. To make everyone happy you should do research in advance to have the numbers in hand before the beginning of the negotiations. In most cases, it’s better to motivate a distributor with a decent back margin than give a deep discount.

-

Custom duty

Market players can’t influence custom duty % directly. However, they should check in advance what HS Code/Codes the product belongs to because duty can be significantly different. Also, in some countries, the % of the duty for some products makes the whole importation story senseless. For example, in India, the custom duty for alcohol other than beer is 150%. And this is 100% for imported beer. The vendor should produce in India or make the product dead cheap. Otherwise, it doesn’t have any chance to be competitive.

There are a good number of unknowns in pricing structure when a company starts penetrating a new market. How to find out if the local distributors are willing to engage with the same wholesale margin as wholesalers in a home market? How to find out what should be TEV for local consumers? How to prepare optimal commercial policy for retailers? Even highly competitive export staff should be well prepared before trying to identify a potential local partner. We recommend doing research on new market conditions in advance.