In the dynamic landscape of the beauty market, our experiences as consultants have yielded a clear message from diverse markets: the cosmetics market is flooded with an ever-expanding array of products across categories such as skincare, haircare, makeup, and more. However, local market players are unceasingly in pursuit of original, unusual, and innovative offerings.

The beauty market stands out as one of the most vibrant segments within the consumer goods industry. According to Statista’s forecast, the global beauty industry’s turnover is poised to reach $625 billion this year, with an anticipated additional growth of over $100 billion (at a 3.32% CAGR) over the next five years.

Beauty & Personal Care – Worldwide, Source: www.statista.com

Moreover, cosmetics technology startups are experiencing rapid growth. In response to the evolving landscape, beauty product manufacturers are striving to expand their presence, enhance their global reach, and tap into new markets, with the support of cosmetics tech firms. Within this dynamic industry, companies are actively exploring novel ingredients, formulations, and emerging trends.

As an illustration, a French cosmetics company, Zarparane, has introduced an inventive ingredient derived from saffron and its flowers (Crocus sativus), known for their abundant antioxidants and other valuable actives that hold significant potential in the beauty industry.

In terms of beauty distribution channels, both, brick and mortar, and e-commerce segments are increasing but internet sales are getting a % share from groceries and department stores. According to the report issued by McKinsey Research Institute, sales share generated by e-commerce channels globally will reach 25-26% in 2027 (while department store share will shrink to 7%).

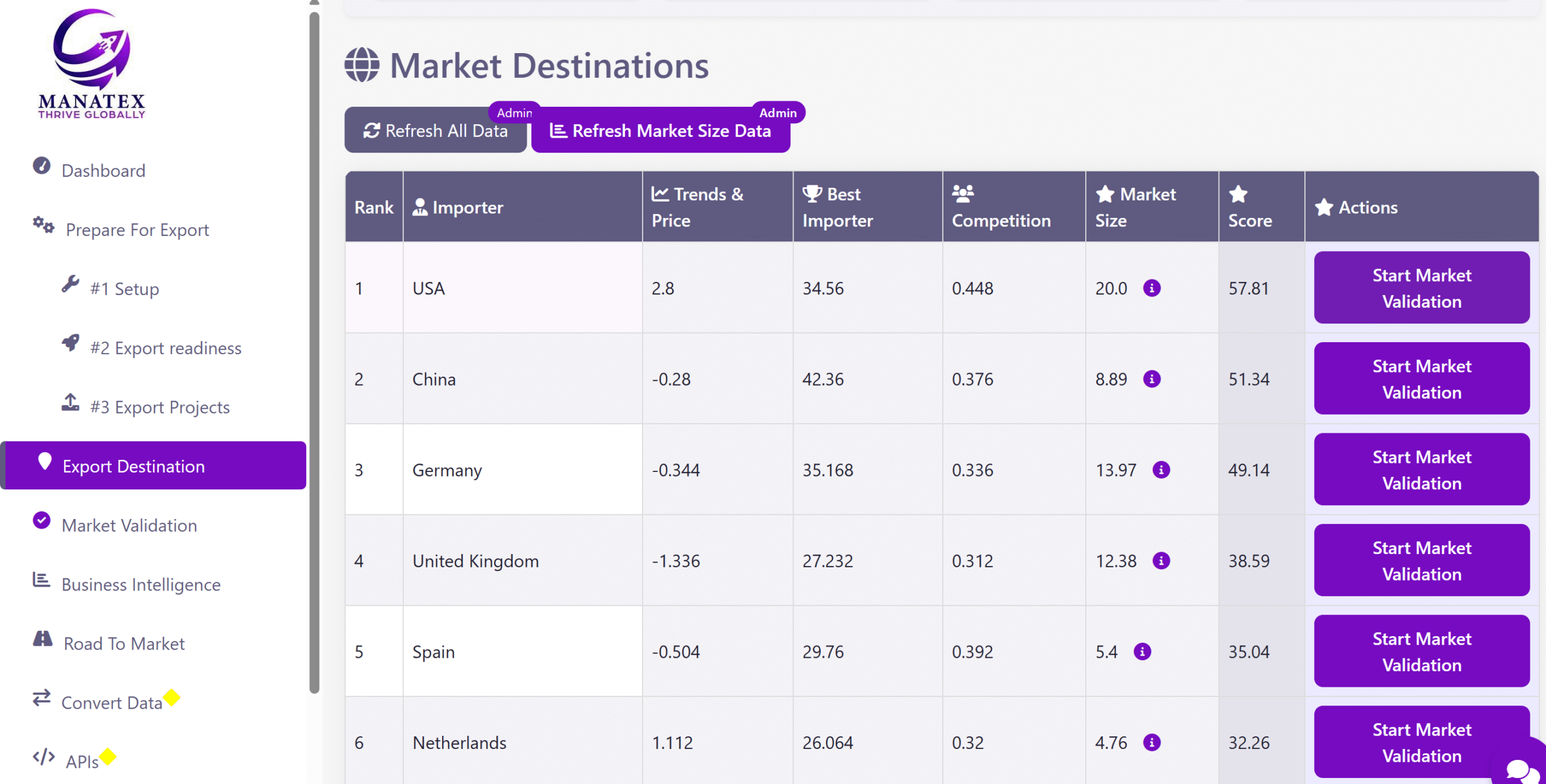

In terms of expansion markets potential, McKinsey teams states in their “Beauty Market Special State of Fashion” report (2023):

- China, the world’s second-largest beauty market at about $65 billion, will continue to grow at an 8 percent CAGR over the next four years, though economic and other challenges are prompting brands to seek growth in alternative markets.

- At roughly $77 billion, the US market is expected to come into sharper focus, but hyper-segmentation and a diverse channel strategy will be required.

- India and the Middle East stand out as emerging hotspots with underserved consumers open to local and foreign brands.

While China and the US remain key markets, global brands should consider widening their global aperture. Two markets capturing the attention of many beauty players, albeit for very different reasons, are India and the Middle East.

Projected sales growth by region and category, USD (billions), growth to 2027, and CAGR, 2022–2027, %, Source: www.mckinsey.com

Speaking of opportunities in cosmetics industry, the market in Middle Eastern countries doesn’t look very big at first glance. However, it’s forecasted to almost double in the next few years mainly because of the growing wealth of the local inhabitants and government initiatives in the KSA and UAE (for example: Saudi 2030).

While expanding internationally, companies – producers of beauty products should keep in mind several global trends:

- Over the last few years, the beauty sector has become enamored with wellness and themes like ‘beauty from the inside out’ and self-care. This means the whole marketing and distribution strategy must be adjusted.

- Gen Z people do care about sustainability and want to be associated with the values of the companies whose products they choose.

- Luxury seems to be an underserved market segment in the beauty industry (compared to apparel, spirits, etc). However, the two biggest markets for these products are still the same: the US and China.

- The market is rapidly growing and changing. It’s not possible to stay still if the company wants to survive in the long term.

Not many young people worldwide care exclusively about “Provence-like” sentiments or “Olive-oil-like” ingredients. On top of it, the competition continuously increasing too. Local partners choose promising vendors to collaborate with – innovative, strong in marketing, and those who respond fast.

Poets and philosophers have argued about beauty and its source for thousands of years. Eventually, in the 21st century, the Beauty Sector became truly commercial. However, the question: who will travel along this road and who will be pushed to the sidelines due to a lack of competitiveness remains open.