In the previous article, we summarized a few “mistakes” that small and medium-sized companies make most often in Export and International Expansion: [Link to the Part 1]

Part 2

Mistake #4: Underestimating export costs

Small and medium-sized enterprises often overlook the real cost of export and market entry.

The cost of customer acquisition is often neglected; expensive and ineffective tools (some trade fairs) are often chosen instead of more affordable ones. Market research reports are bought from famous and expensive companies (often, companies make mistakes even at this stage). Top management wakes up in the morning to realize that dozens of thousands of euros have been spent on some market entry, and nothing has been done yet.

On top of it, even the costs directly associated with exporting, such as transportation, insurance, laboratories, etc often overlooked or forgotten. This can seriously affect export operations and the negotiation process, especially in the case of trade with low margin categories (e.g., commodities).

What should be done?

Generative AI tools e.g. [ManatexGPT] can help you do a basic screening for potential costs associated but be careful with them if you need to calculate something with high precision (these tools are often hallucinating with numbers).

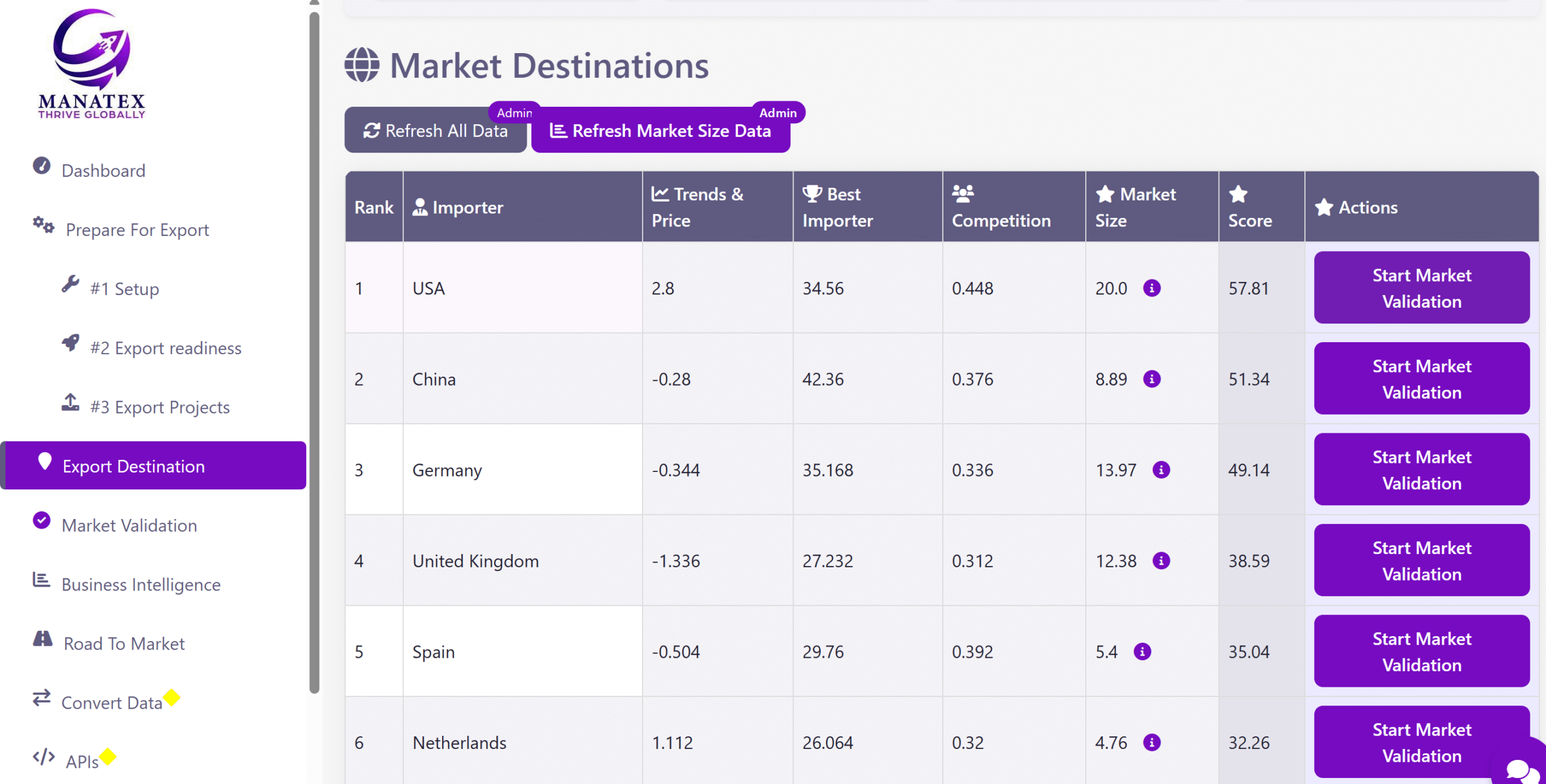

AI agent [Manatex.digital] – digital export assistant, built by our company, provides the cost estimation for B2b market entry (before the contract is signed).

Make sure, market research on local regulations (local requirements for packaging/stickering adaptation) is done well. It’s better to invest at this point than make a mistake with some missed costs and negotiate the wrong price as a result.

Mistake #5: Choosing inappropriate distribution channels

Countries vary from each other. People in different countries have different shopping habits and adopt various consumer behavioral patterns. This means the local partner’s ability to bring the product to the right shelf is critical.

What should be done?

Identify the main distribution channel for each country. Example: consumers of dietary supplements in one country easily start buying new brands online (they read Amazon reviews, and that’s enough). In another country, the most critical decision-making driver can be the opinion of a doctor or a pharmacist. Thus, in this case, it’s critical to put a new brand on the shelf of a pharmacy.

Also, keep in mind that (e.g., for consumer goods) numeric (quantity) and weighted (quality) distribution KPIs matter. Being presented in the channel that generates higher revenue, and makes the brand famous (key retail chains, e.g.), speaks volumes and makes the difference.

AI agent [Manatex.digital] – digital export assistant is capable of providing companies with business intelligence, and is also calculating the most appropriate market entry scenarios for each company and a country.

TO BE CONTINUED…