In 2023, the South Asia, East Asia, and Pacific regions reached a population exceeding 4.3 billion, representing over 54% of the global population (World Bank). This vast demographic, combined with rapid digitalization and shifting trade dynamics, has made Asia the core of transformative changes in international trade.

Asian economies are thriving in export-driven sectors, capitalizing on high-demand industries such as technology, automobiles, and high-tech equipment. According to recent OECD data (Q2, 2024), China and Korea, for instance, saw significant growth in merchandise exports fueled by sectors like automotive, semiconductors, and advanced technology.

There is a similar trade in services. While the export of services is growing everywhere in the world, Asian countries are experiencing fast growth, OECD (Q2, 2024 results):“In Japan, services exports rose by 1.6%, mainly driven by high revenues from transport and other business services. In Korea, services exports increased sharply, fuelled by transport (freight in particular), travel, and ICT services. In India, trade in services surged, with exports rising by 4.4%. In China, easing of visa requirements boosted travel and total services exports by 4.0%)”

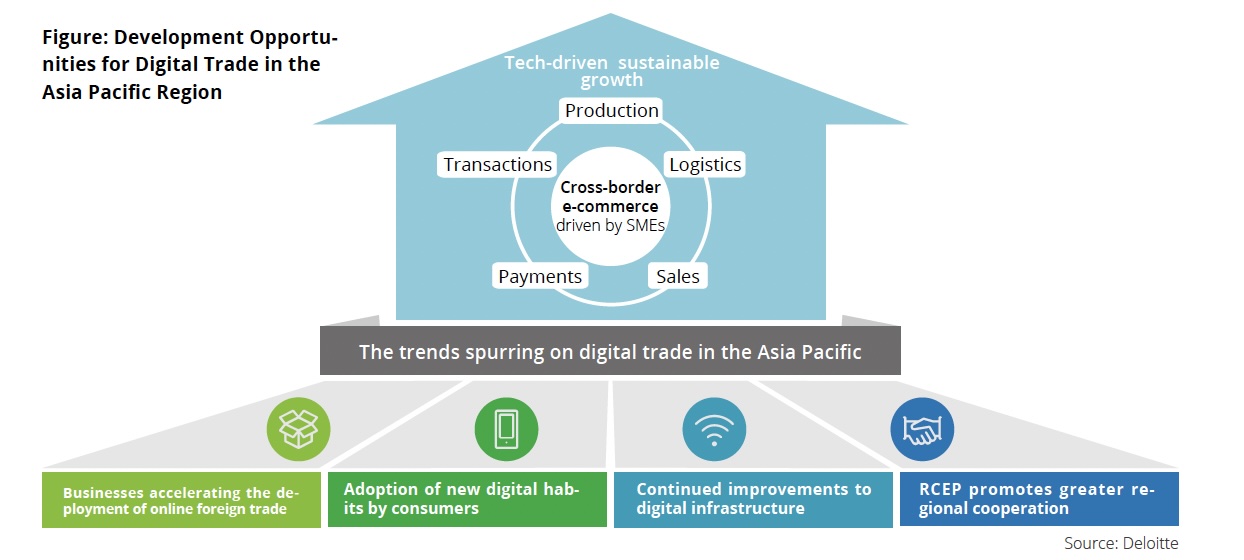

This is all happening against a backdrop of major changes in the geometry of global trade. According to a recent article, published by McKinsey Research Institute, Asia is presently the world’s second-most integrated commercial region, following the European Union. In other words, trade connections inside Asia intensify economic interdependence. China and ASEAN countries have increased trade with each other, and this trend has dramatically accelerated in the last 20 years.

Picture #1: ASEAN and China are each other’s top trading partners, with trade between them growing rapidly (Source: McKinsey Research Institute)

This increased trade between countries has a lot to do with the digitalization of retail and export processes.

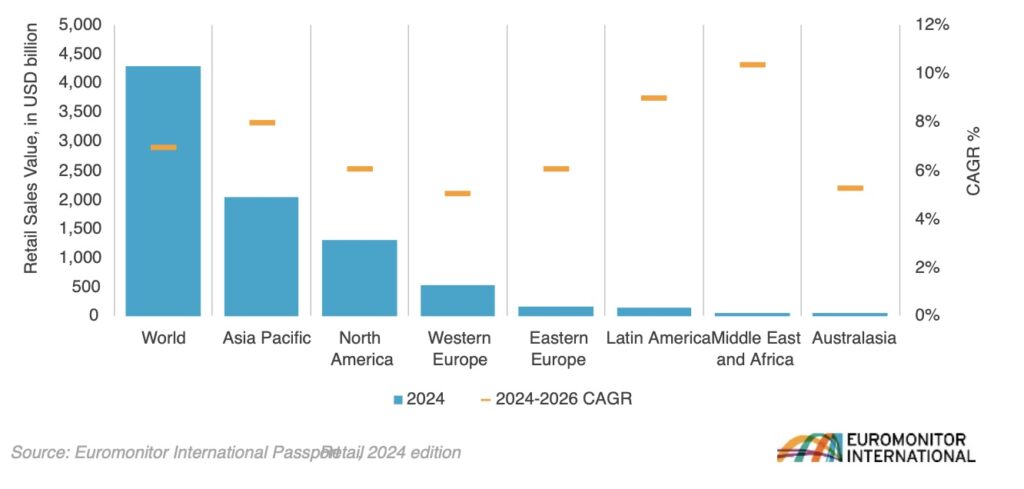

According to Statista, China is the largest player in the e-commerce market, with four other countries in the region (India, Japan, South Korea, and Indonesia) among the top 10. Also, Southeast Asia dominates the top ten e-commerce markets in terms of sales growth. According to Euromonitor, The region’s e-commerce market is predicted to be worth USD 2 trillion in 2024 at constant prices (i.e., after inflation), accounting for 47% of worldwide e-commerce sales. 8% CAGR is expected from 2023 to 2028.

Picture #2: Retail e-commerce market forecasted growth, Global by region (Source: Euromonitor)

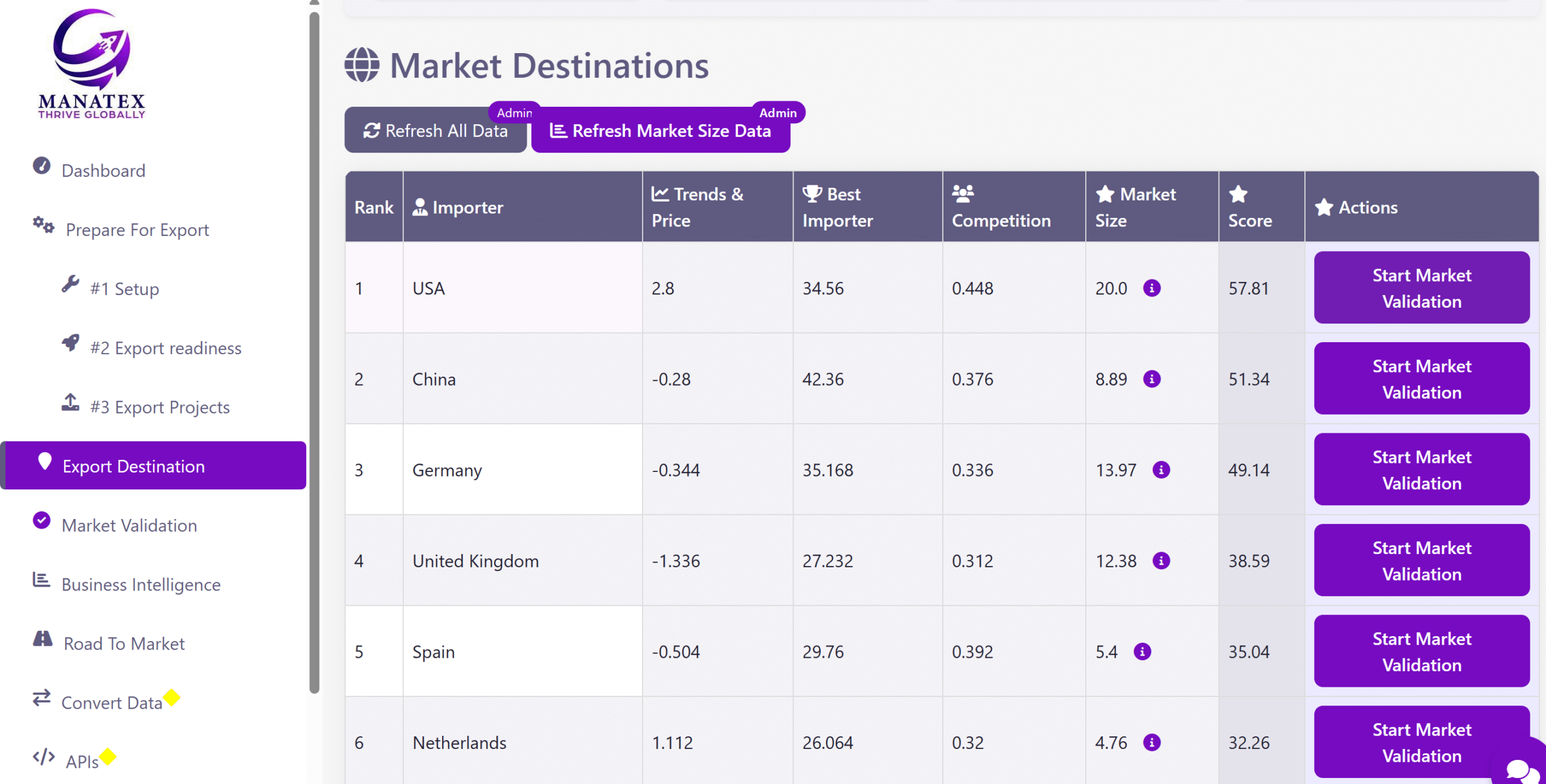

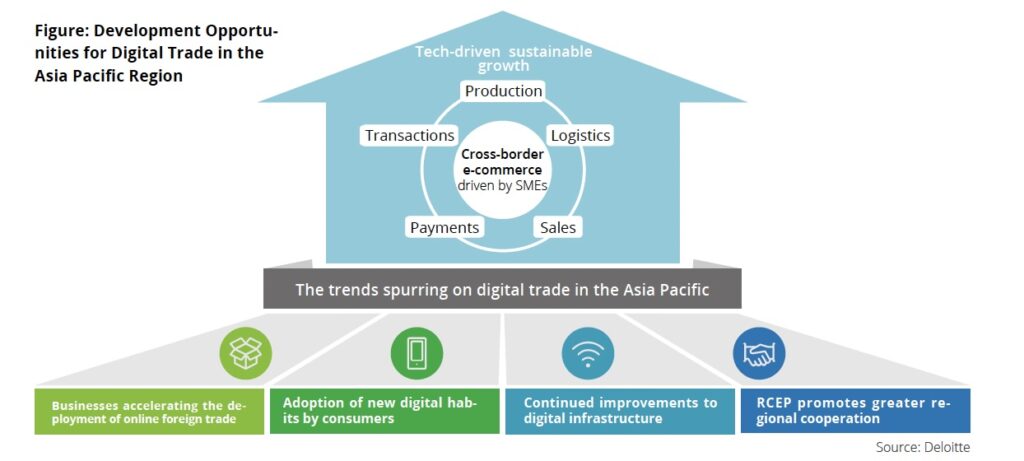

In Asia, the growth of exports via digital platforms has been particularly strong in countries like China, Singapore, and Vietnam. This growth is fueled by rapid digital adoption, supportive government policies, and increased consumer engagement with online shopping. Countries in Southeast Asia are emerging as major players in cross-border e-commerce due to their competitive production costs and expanding digital infrastructure.

According to TechWire Asia, electronics, fashion, beauty products, and food items are among the top product categories experiencing high cross-border demand. Consumers in Asia Pacific increasingly value the ability to compare prices and view reviews online, especially as many people are becoming more cost-conscious. This trend, termed “Value Hacking,” has seen a rise in tech-savvy consumers using online tools to find the best prices, contributing to Asia’s e-commerce market.

Asian countries have also benefited from the rise of micro-multinational enterprises (mMNEs), which are small businesses leveraging digital platforms to reach global markets, often providing unique, customized local products to meet global demand. These mMNEs are a key driver of e-commerce growth across Asia, especially in developing regions like Southeast Asia, where infrastructure is evolving to support faster logistics and smoother digital transactions.

Picture #3: Development Opportunities for Digital Trade In the Asia Pacific region (source: Deloitte)

AI technology is expected to significantly boost the growth of digital platform-based exports in Asia by improving e-commerce efficiency, personalization, and scalability.

Here are some of the ways AI is fuelling this trend:

- Personalized Consumer Experiences: AI tools, particularly generative AI and machine learning, allow digital platforms to deliver highly personalized retail experiences. Alibaba and Lazada are leading the way in AI-driven suggestions, enabling Asian SMEs to connect with global consumers on a more personalized level.

- Streamlined Logistics and Supply Chains: AI-powered logistics management technologies optimize inventory, forecast demand, and identify effective delivery routes, thereby decreasing delays and costs. In Asia, where cross-border logistics can be challenging, AI assists platforms in coordinating shipments and anticipating demand variations, helping SMEs to scale their exports more profitably. Additionally, AI-based demand forecasting helps firms prevent supply shortages or overstocking, which is especially important for popular sectors like electronics, fashion, and beauty.

- Enhanced Language Translation. AI translation solutions enable real-time communication across many languages, reducing obstacles in regions such as Japan, South Korea, and Southeast Asia. This is critical for mMNEs in Asia that want to establish themselves in multiple areas without incurring hefty localization expenses.

- Fraud Detection and Cybersecurity: As cross-border e-commerce grows, AI-driven cybersecurity solutions help detect and prevent fraud, ensuring consumer trust.

AI’s contributions in these areas not only boost the competitiveness of Asian SMEs, but also drive regional and global e-commerce growth. The technology’s capacity to scale operations, decrease costs, and boost user pleasure has solidified its place in Asia’s digital platform exports, propelling the region to the forefront of AI-powered cross-border commerce.